From July 1, 2025: Non-Pensioners Aged 75+ to Receive VND 500,000/Month

The government has just issued Decree 176/2025/ND-CP, guiding the implementation of social retirement benefits under the 2024 Social Insurance Law. Accordingly, starting July 1, 2025, individuals aged 75 and above who do not receive a pension or monthly social insurance allowance (or whose benefits are below the prescribed standard) will be eligible for a social retirement allowance of VND 500,000 per month. Additionally, individuals aged 70 to under 75 who belong to poor or near-poor households will also be eligible if they meet all the specified conditions.

Citizens can submit their applications at the commune-level People’s Committee, via post, or through the national public service portal. The maximum processing time is 10 working days from the receipt of a complete and valid application. Benefit payments will be made by service organizations with networks extending to the commune level, via bank transfer, cash, or home delivery if the recipient is unable to travel.

Benefits will be temporarily suspended if the recipient changes residence or no longer meets the eligibility criteria. If a recipient who is currently receiving benefits or has submitted an application passes away, their next of kin will be considered for funeral expense support, with a processing time of no more than 3 working days. Funding for these payments is secured by the state budget as stipulated in Decree 20/2021/ND-CP, and provincial People’s Committees may provide additional support based on actual conditions.

Read Decree 176/2025/ND-CP (Viet)

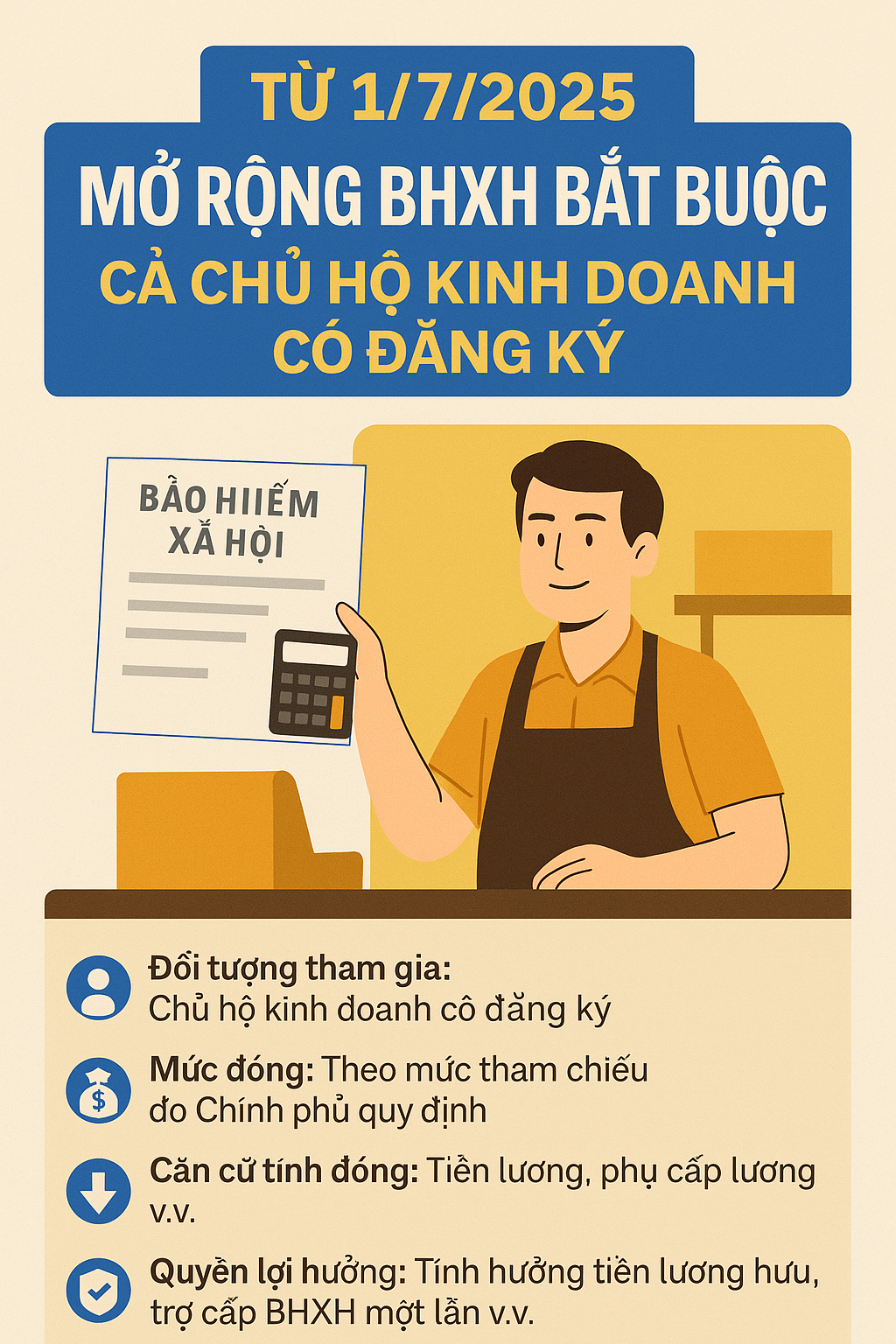

From July 1, 2025: Expanded Scope of Compulsory Social Insurance under Decree 158

The government has just issued Decree 158/2025/ND-CP, providing detailed guidance on the implementation of compulsory social insurance policies under the 2024 Social Insurance Law. Accordingly, from July 1, 2025, many new provisions will be applied, including the expansion of compulsory social insurance coverage, clear regulations on retroactive contributions, contribution levels, and processing times for applications.

Specifically, in addition to employees working under contracts as before, enterprise managers, cooperative executive managers receiving salaries, individuals working abroad but receiving salaries from Vietnam, and part-time workers earning above the minimum monthly wage will also be subject to compulsory social insurance. Notably, individual business households with business registration and tax declarations based on the declaration method will officially be required to participate in compulsory social insurance from July 1, 2025. For business households that have not yet declared taxes, the mandatory participation date will be postponed to July 1, 2029, to allow for adaptation.

The Decree also clearly stipulates some cases not subject to compulsory social insurance, such as individuals receiving disability allowances or one-time benefits under previous Prime Minister’s Decisions (Nos. 91/2000, 613/2010…), employees on probation, or those with contracts whose income does not meet the prescribed threshold. Furthermore, individuals who do not work for at least 14 days in a month will not be required to contribute social insurance for that month, meaning that month will not count towards their contribution period.

Regarding contribution levels, methods, and payment deadlines, these remain unchanged from the Social Insurance Law, with employees and employers sharing contribution responsibilities according to prescribed ratios. In cases of salary increases, changes in work type, or additional working periods, the social insurance agency will collect the deficit, but not exceeding 12 months, and may charge late payment interest if the prescribed deadline is exceeded.

The processing of applications related to participation, adjustments, retroactive contributions, or benefit claims is assigned to the social insurance agency within specific deadlines, ensuring transparency. Employers and individuals can submit applications directly to the district-level social insurance agency, via post, or through the national public service portal.

Decree 158/2025/ND-CP takes effect on July 1, 2025, and concurrently repeals the entirety of Decree 115/2015/ND-CP and some related provisions in older decrees. The issuance of this new decree is considered a significant step in modernizing the social insurance system, increasing coverage, and ensuring long-term benefits for employees and businesses in the economy.

Read Decree 158/2025/ND-CP (Viet)

From July 1, 2025: Increased Statute of Limitations for Sanctions, Expanded Authority Under Amended Law on Administrative Sanctions

On June 25, 2025, the National Assembly passed Law No. 88/2025/QH15, amending and supplementing a number of articles of the Law on Handling Administrative Violations. This Law will officially take effect from July 1, 2025, introducing many notable new points regarding authority, procedures, and forms of sanctions, aimed at enhancing the effectiveness of law enforcement in state management.

Significant Changes to Statute of Limitations and Sanctioning Authority

One of the key highlights is the adjustment of the statute of limitations for administrative sanctions. While the general statute of limitations remains 1 year, for specific fields such as taxation, securities, insurance, and environment, it has been extended to 2 years. Furthermore, if a violation is referred back by a procedural agency for administrative handling, the statute of limitations will be extended by an additional year, up to a maximum of 3 years.The Law also expands sanctioning authority to several new positions. Specifically, deputy heads of specialized agencies at all levels of the People’s Committee will have the power to impose sanctions within their assigned scope. Commune-level police are granted additional authority to prepare administrative sanction dossiers for violators related to local public order, drug addicts, or individuals with repeated law violations.

Enhanced On-Site Sanctions and Digital Technology Application

Another important improvement is the encouragement of sanctions without official records for minor violations. Accordingly, if only a warning or a fine of less than VND 500,000 for individuals (or VND 1,000,000 for organizations) is applied, the competent authority can issue a sanction decision immediately without requiring an official record, thereby reducing administrative procedures.

Notably, the Law for the first time recognizes and encourages the use of electronic sanctioning methods. The creation of official records, signing of confirmations, and delivery of sanction decisions can all be performed through electronic systems and digital signatures, facilitating convenience for both citizens and management agencies. Additionally, in cases requiring temporary seizure of exhibits and vehicles, the preparation of dossiers, sealing, and storage can also be carried out through electronic processes as guided by the Government.

Towards Procedural Reform, Ensuring Legitimate Rights and Interests

With numerous extensive amendments, Law No. 88/2025/QH15 is expected to enhance the effectiveness of administrative sanctions, shorten processing times, reduce costs and paperwork, and create a solid legal basis for the application of digital transformation in public administration. The Law also contributes to ensuring the legitimate rights and interests of individuals and organizations, especially in the context of increasing complexity and diversity of administrative violations.

Read Law No. 88/2025/QH15 (Eng)

Read Law No. 88/2025/QH15 (Viet)

From July 1, 2025: Stricter VAT Deduction with Non-Cash Payments

On July 1, 2025, the government officially issued Decree 181/2025/ND-CP, guiding the implementation of the 2024 Value Added Tax Law, effective immediately. The Decree, comprising 4 chapters and 40 articles, replaces Decree 209/2013 and 49/2022, clarifying issues related to taxpayers, taxable/non-taxable subjects, tax basis, time of determination, and conditions for deduction and refund.

Key New Highlight: Invoices ≥ VND 5 Million Require Bank Transfer for Deduction

From July 1, 2025, all invoices with a value of VND 5 million or more (including VAT) must be paid non-cash to be eligible for input VAT deduction, except for special cases specified in point b, Clause 2, Article 14 of the VAT Law, detailed in Article 26 of Decree 181. If multiple purchases are made on the same day and their total reaches VND 5 million or more, non-cash payment documents are also required for eligibility.

Expanded Scope and Subjects of VAT Application

The Decree clarifies taxpayer subjects, adding foreign suppliers via digital platforms, organizations managing e-commerce platforms, and cases related to payments by foreign parties. It also clearly defines various goods and services exempted from tax and how to determine the tax basis for each industry, such as electricity, water, books, printing, pawnbroking, and package tours.

Strict Deduction and Tax Refund — Ensuring Taxpayer Rights

Cases of natural loss and fixed assets invested for both taxable and non-taxable activities are clearly regulated regarding temporary deduction methods, adjustments within three years, and not exceeding the initially incurred input tax amount. Tax refund conditions require input VAT of VND 300 million or more or ODA/humanitarian aid projects, along with many strict regulations on dossiers and declarations. Expenses such as gifts, advertising, and pawnbroking are considered for input deduction if valid documents are available, helping businesses optimize their legitimate benefits.

Conclusion: Towards Transparent, Digitalized VAT in the Future

Decree 181/2025/ND-CP marks a significant step in VAT management, particularly concerning non-cash payment regulations and clear, strict criteria for deduction and refund. Businesses’ finance and accounting departments need to quickly update internal procedures, e-invoice software, transfer documents, and management systems to comply with legal requirements and avoid tax risks.

Read Decree 181/2025/ND-CP (Viet)

Read Decree 181/2025/ND-CP (Eng)

From July 1, 2025: E-commerce Platforms Must Withhold Tax at Source

On June 9, 2025, the government issued Decree 117/2025/ND-CP, regulating tax management for e-commerce and digital platform business activities of households and individuals. The Decree takes effect from July 1, 2025, replacing Decision 843/QD-BTC of 2021, marking a strong step forward in clarifying tax obligations in the digital economy.

✅ Platforms Must Withhold and Remit Taxes on Behalf of Sellers

Under the new regulations, organizations operating e-commerce platforms (both domestic and foreign) are responsible for withholding and remitting VAT and Personal Income Tax (PIT) on behalf of households and individuals conducting sales or providing services through their platforms. Withholding will be performed at the source, for each payment transaction. If a platform cannot withhold (due to not being involved in the payment process), it must transmit full transaction data to the tax authority for direct management. Simultaneously, platforms must issue annual electronic withholding certificates to individual businesses and declare them to the tax authority.

✅ Individuals and Business Households to Declare and Refund Taxes Electronically

Resident and non-resident individuals and business households on platforms will declare and pay taxes electronically, either regularly (monthly) or on a per-transaction basis, depending on the scale of their operations. If taxes have already been withheld and remitted by the platform, there is no need to re-declare for that income portion. In cases of order refunds, returns, or overpayment of tax, individuals can apply for an electronic tax refund based on documents and data provided by the platform. Withholding and refunds also apply to other taxes such as special consumption tax, natural resource tax, and environmental protection tax if obligations arise.

✅ Added Obligations for Transparency and Data Synchronization

The Decree requires individual businesses to provide their tax codes, personal identification numbers, and other mandatory information to the platform. Conversely, platform operating organizations are responsible for synchronizing data, protecting information, and reporting periodically to the tax authority according to prescribed templates.

📌 Impact & Recommendations

Tax management based on the “withholding at source” model will reduce the risk of revenue loss while simplifying procedures for individual businesses, especially those not specialized in accounting. However, platforms and individuals need to proactively review their transaction systems, update technical procedures and data to comply with regulations, avoiding violations and administrative penalties.

Read Decree 117/2025/ND-CP (Viet)

Read Decree 117/2025/ND-CP (Eng)

From July 1, 2025: Simpler, Faster Business and Household Registration

From July 1, 2025, Decree 168/2025/ND-CP officially takes effect, marking a significant step forward in administrative procedure reform for business registration. The Decree replaces old regulations on business and household registration, introducing a series of new provisions that significantly reduce paperwork, expedite application processing, and better support citizens and businesses.

One of the most notable changes is that the entire business registration process, from application submission to result retrieval, can be done entirely on the National Business Registration Portal. Users only need to authenticate via electronic identification, digital signature, or chip-embedded citizen ID card – eliminating the need to print documents, stamp, or submit in person as before.

For cases where individuals already have a personal identification number, businesses will not be required to submit copies of legal documents such as ID cards or passports. This improvement is considered to save significant time and costs for both startups and businesses expanding their operations.

Notably, the Decree also adds a “technical backup” mechanism – allowing citizens and businesses to submit paper applications in case the electronic system encounters issues. Data will be updated to the system within 30 days, avoiding interruptions in the business registration process.

Furthermore, business registration will now be automatically linked with tax and social insurance agencies, helping state management units quickly grasp new registrations, limit overlaps, and increase management efficiency.

In addition, Decree 168/2025/ND-CP also sets out clear regulations to prevent harassment of citizens, such as strictly prohibiting requests for multiple sets of documents and forbidding interference or demands for information beyond authority.

According to experts, with its strong reform spirit, the new Decree will not only support the startup community but also promote the digital transformation process in public administration – which is expected to create positive momentum for the investment and business environment in the coming period.

Read Decree 168/2025/ND-CP (Viet)